The quick story of Retirement Annuities...

Some people say retirement annuities are a waste of time and others swear by it.

My argument is that one must just understand the fundamentals behind a Retirement Annuity and you will instantly know if this investment vehicle is for you or not.

So essentially, a retirement annuity is used to provide one with income in retirement with the benefit of having the taxman contributing to your savings.

What is a retirement annuity?

A retirement annuity or RA for short, is a retirement vehicle that has certain benefits provided for by the Pension Funds Act. It is similar to a pension or provident fund, but is used by people who do not have such benefits at work or who want to create their own fund or supplement their existing retirement planning.

The definition of "retirement": of the action or fact of leaving one's job and ceasing to work.

The definition of "annuity": a fixed sum of money paid to someone each year(or month), typically for the rest of their life. It comes from the Latin word, annuus which means ?yearly?.

It is merely an investment that makes use of certain tax laws and benefits used to provide income in retirement.

Worth it or worthless?

The main answer to this question is really a simple one.

What you put into an RA is mostly what you will get out.

So if you contribute R100 per month into your Retirement Annuity, you could expect to get out roughly R400 per month, valued in today?s money. And this is if you still have 25 years to save.

However, fees can become a problem too. This will be covered under the CONTROVERSY section later on.

This is the main confusion regarding retirement annuities. Most people as unaware of what it takes to build a retirement fund that is actually able to provide for you in retirement.

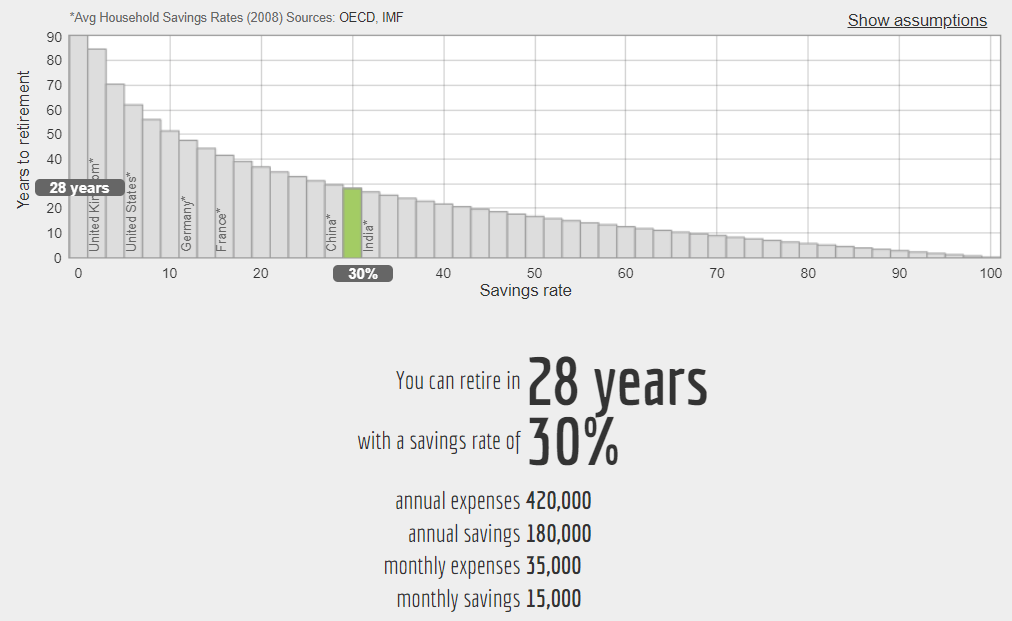

One should be saving around 25% for 30 years to replace your income and for employees who have to retire at age 60 to 65 this is a huge issue.

PLEASE DON'T CLICK AWAY JUST YET. HERE IS WHY...

Source: Networthify's when can I retire calculator.

I know this is a huge savings rate, but it is the uncomfortable truth. The good news is that not all of your savings have to go into a Retirement Annuity only, some can (and should) go into a short-term savings account and even into investment properties for example which you can use for holidays and emergencies.

Increasing my clients' savings rates is almost half of the work I do for my clients. The actual policies usually take a second seat.

Below there are some calculators that show you how I got to this number, and how you can retire early as well.

Here are some retirement calculators, each with a different purpose, just click the links:

- Calculate at what age you will retire with Sygnia's Retirement Age Calculator.

- Calculate how much you need to save for your retirement with Sanlam's Retirement Goal Calculator.

- Calculate how many years it will take to retire at a specific percentage of savings with Networthify's when can I retire Calculator?

What are the benefits of Retirement Annuities?

- Similar to a tax-free savings account, you won't pay tax on Retirement Annuity's investment contributions(initially), returns, interest income, dividends, or capital gains.

- Depending on your tax planning, SARS will pay money back to you in the form of a tax refund for saving into a retirement annuity. This can be reused to invest further or to ease the expense of investing.

- On retirement, you can take up to a third of your Retirement Annuity as a lump sum and if the lump sum is below R247,500 you can take the entire amount.

- RA's are protected by law from being withdrawn, meaning even if you get sued your RA is protected. Not even bankruptcy can touch your RA.

The technical axioms of a Retirement Annuity:

- The first R500,000 that you take as a lump sum is not taxed. Anything more that you take as a lump sum is taxed at incremental rates: the next R200,000 is taxed at 18%, the next R350,000 after that at 27%, and anything after that at 36%.

- You may deduct up to 27.5% of your contributions to a Retirement Annuity of your taxable income or gross remuneration. The total contribution amount that is tax-deductible may not exceed R350,000 per annum. Contributions over the annual rand limits may be rolled over to future years.

- You may have many individual retirement annuities, as long as you do not exceed your overall provision.

- You can retire at age 55. However, you can withdraw your funds earlier on immigration or health issues.

- You are able to select beneficiaries on your retirement annuity.

Fees:

- Retirement annuities have total fees ranging from 1% to 3% per year on average. But some companies charge much higher, see the controversy section below.

- Your fund fee is separate from your platform fee, your advisor's fee, and your investment fee.

- Your minimum contributions are usually around R500 per month or R5000 once off depending on different companies.

The controversy...

The main controversy of Retirement Annuities is the high fees. Specifically, this is a problem only for RA's that are created under "insurance wrappers" or "Life RA" retirement annuities.

The problem is this: there is a large upfront commission fee that goes to the financial advisor, and if you were to stop your monthly contributions there is a "penalty" to be paid that comes off your investment balance. There is also a large ongoing fee.

Now, if you would compare a simple RA, no upfront fees, very low ongoing fees, the simple RA would be better than the "insurance wrappers" or "Life RA" retirement annuities.

On the other hand, one simply cannot ignore the benefits of such retirement annuities, as they also pay bonuses and discount fees which outperform standard RAs in some scenarios. Some of these types of RA's go as far as to pay back more than 100% of the fees back into your RA.

This is where good financial advice comes in to advise the best product for one's actual situation and needs. Some clients do NOT need RA's and actually would be worst off if they did because their needs might be that they need access to their monies before age 55.

Here is my advice if you are looking for a retirement annuity:

What should employees do:

Save 20% towards your retirement in the form of a Retirement Annuity(RA) or work pension and or provident. Then save 10% into a short-term investment vehicle like a unit trust or even a bank account. Bringing your total savings to 30% per month. Do this for your whole life and even if you make mistakes you will still make it to affluence and abundance.

My advice if you are a business owner:

Save 10% towards a retirement annuity and 20% towards a short-term savings account so you can build reserves to protect you from the difficult times all business owners inevitably face. This is because retirement annuities are protected by law from creditors. meaning once it is in there it stays in there.

P.S. If you are a business owner with a profitable business, there is a different product that can take your tax rate down to zero while still granting you access to your monies. Please contact me for more info.

P.P.S. This advice is a general and untailored example of a good plan, however, one should keep in mind that one's own circumstances will and MUST guide one's personal plan. This is again where a good financial advisor comes in.

How to get a retirement annuity?

Retirement Annuities are usually sold through a financial advisor or broker. Their commission depends on the supplier, but usually is around 1% to 0.5% ongoing annual fee, or an upfront commission of max 3%.

The advisor will work with you to select an investment risk apatite and select the best supplier for your needs.

Always look for an independent financial advisor.

The information in this blog post does not constitute advice as defined by the Financial Advisory and Intermediary Services Act, 37 of 2002.